The area senior center’s (Thayer, Alton, and West Plains) are helping seniors do their taxes. Appointment’s are being taken. Seniors must also meet certain criteria to be helped out.

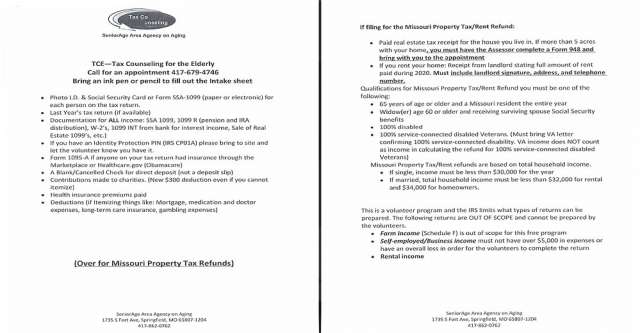

Tax Counseling for Elderly

For filling out the intake sheet, you need multiple items. You will need your photo ID and social security car or Form SSA-1099 for each person on the tax return; last year’s tax return (if available); documentation for all income: SSA 1099, 1099 R, W-2’s 1099 INT from bank for interest income, or Sale of Real Estate 1099’s. If you have a Identity Protection Pin, bring it and show it to the volunteer. You will need Form 1095-A if anyone on your tax return had insurance through Obamacare. Seniors will also need to bring a blank/canceled check for direct deposit, contributions made to charities; health insurance premiums paid; and deductions (if itemizing things like: mortgage, medication and doctor expenses, long-term care insurance, gambling expenses).

MO Property Tax/Rent Refund

If you’re doing the Missouri property tax/rent refund, you will need your paid real estate tax receipt for the house you live in. If you have more than 5 acres, you must have the assessor complete a Form 948 and you must bring it with you. If you rent your home, you need to bring a receipt form the landlord stating full amount of rent paid during 2020. It must include the landlord’s signature, address, and telephone number.

Qualifications

To be qualified for the Missouri property tax/rent refund, you have to be 65 years of age or older and a Missouri resident the entire year; a widow(er) who is 60 years or older and receiving surviving spouse Social Security benefits; 100% disabled; or 100% service-connected disabled veterans. The Missouri property tax/rent refunds are based on total household income: if you’re single, your income must be less than $30,000 for the year; if married, your total household income must be less than $32,000 for rental and $34,000 for homeowners.

No Help

This is a volunteer program and the IRS limits what types of returns can be prepared. The following returns are out of scope and cannot be prepared by the volunteers: Farm Income, self-employed/business income, and rental income.

Set An Appointment

If you want to set an appointment, call 417-679-4746 or your local seniorAge senior center:

- Alton: 417-778-7342

- Thayer: 417-264-7354

- West Plains: 417-256-4055